Explore web search results related to this domain and discover relevant information.

Zillow Home Value Index (ZHVI), built from the ground up by measuring monthly changes in property level Zestimates, captures both the level and home values across a wide variety of geographies and housing types.Learn more about the Zillow Home Value Index · Typical Home Values: $221,032 · 1-year ...

Zillow Home Value Index (ZHVI), built from the ground up by measuring monthly changes in property level Zestimates, captures both the level and home values across a wide variety of geographies and housing types.Learn more about the Zillow Home Value Index · Typical Home Values: $221,032 · 1-year Value Change: -2.2% (Data through July 31, 2023) --1-year Market Forecast · 0.996Median sale to list ratio(June 30, 2023) 28.1%Percent of sales over list price(June 30, 2023) 50.4%Percent of sales under list price(June 30, 2023) 17Median days to pending(July 31, 2023) (Metric availability is based on market coverage and data) How does this data help me?How does this data help me? Zillow's metrics aim to inform and support the decision-making process with relevant market data by measuring monthly market changes across various geographies and housing types.An equal housing lender.

Today, in the Real Estate Newsletter: What will happen with House Prices? Brief excerpt: Almost every day a journalist or an analyst asks m...

Almost every day a journalist or an analyst asks me what will happen with house prices. Every cycle is different, and usually I focus on inventory, sales, and months-of-supply to answer this question. However, there have been significant policy changes this year, especially with trade and immigration.The Sahm rule is a measure of changes in the unemployment rate. It compares the three-month moving average of the unemployment rate (U3) to the minimum of the three-month averages from the previous 12 months. In general, a rising unemployment rate corresponds to weaker house prices.Of course, correlation does not imply causation. And there are exceptions - like at the onset of the pandemic when the unemployment increased sharply, but house prices took off (mortgage rates fell sharply and most potential homebuyers stayed employed).This is much more in the article.A top ranked economics and finance blog with a focus on the housing market

Almost every day a journalist or an analyst asks me what will happen with house prices.

Note that the median price is impacted by the mix of homes sold. The seasonally adjusted Case-Shiller National Index is down slightly year-to-date (YTD). The index was at 327.90 in December 2024 and was at 326.36 in the June report. And the Freddie Mac HPI SA is down slightly YTD. The index was at 299.66 in December, and is now at 296.56, a decline of 0.8%. Based on the trend, the increase in inventory (and months-of-supply), it appears house prices will be down slightly in 2025.In general, a rising unemployment rate corresponds to weaker house prices. Of course, correlation does not imply causation.And there are exceptions - like at the onset of the pandemic when the unemployment increased sharply, but house prices took off (mortgage rates fell sharply and most potential homebuyers stayed employed).If the unemployment rate continues to rise, this will likely put downward pressure on house prices.

“UK house prices rose again in August, up by +0.3% (£932), marking the third consecutive monthly increase. The average property price now stands at £299,331 – a new record high – although annual growth has eased slightly to +2.2%. “The story of the housing market in 2025 has been ...

“UK house prices rose again in August, up by +0.3% (£932), marking the third consecutive monthly increase. The average property price now stands at £299,331 – a new record high – although annual growth has eased slightly to +2.2%. “The story of the housing market in 2025 has been one of stability.Real (price adjusted) new orders in manufacturing were down 2.9% in July 2025 month on month after seasonal and calendar adjustment, according to provisional figures of the ...

The average home value in New York, NY is $808,970, up 3.5% over the past year. Learn more about the New York housing market and real estate trends.

Zillow Home Value Index (ZHVI), built from the ground up by measuring monthly changes in property level Zestimates, captures both the level and home values across a wide variety of geographies and housing types.Learn more about the Zillow Home Value Index

Zillow Home Value Index (ZHVI), built from the ground up by measuring monthly changes in property level Zestimates, captures both the level and home values across a wide variety of geographies and housing types.Learn more about the Zillow Home Value Index · Typical Home Values: $826,592 · 1-year ...

Zillow Home Value Index (ZHVI), built from the ground up by measuring monthly changes in property level Zestimates, captures both the level and home values across a wide variety of geographies and housing types.Learn more about the Zillow Home Value Index · Typical Home Values: $826,592 · 1-year Value Change: -4.7% (Data through September 30, 2023) --1-year Market Forecast · 1.000Median sale to list ratio(August 31, 2023) 42.7%Percent of sales over list price(August 31, 2023) 34.9%Percent of sales under list price(August 31, 2023) 10Median days to pending(September 30, 2023) (Metric availability is based on market coverage and data) How does this data help me?How does this data help me? Zillow's metrics aim to inform and support the decision-making process with relevant market data by measuring monthly market changes across various geographies and housing types.An equal housing lender.

In July 2025, New York home prices were up 4.7% compared to last year, selling for a median price of $900K. On average, homes in New York sell after 52 days on the market compared to 54 days last year. There were 2,921 homes sold in July this year, up from 2,905 last year.

In July 2025, New York home prices were up 4.7% compared to last year, selling for a median price of $900K. On average, homes in New York sell after 52 days on the market compared to 54 days last year. There were 2,921 homes sold in July this year, up from 2,905 last year. ... Based on Redfin calculations of home data from MLS and/or public records. ... To compare other locations to the New York and U.S. housing market, enter a city, neighborhood, state, or zip code into the search bar.REDFIN IS COMMITTED TO AND ABIDES BY THE FAIR HOUSING ACT AND EQUAL OPPORTUNITY ACT.READ REDFIN'S FAIR HOUSING POLICY AND THE NEW YORK STATE FAIR HOUSING NOTICE.The median sale price of a home in New York was $900K last month, up 4.7% since last year.

The average home value in Saginaw, MI is $121,590, up 6.2% over the past year. Learn more about the Saginaw housing market and real estate trends.

Zillow Home Value Index (ZHVI), built from the ground up by measuring monthly changes in property level Zestimates, captures both the level and home values across a wide variety of geographies and housing types.Learn more about the Zillow Home Value Index

The average home value in Los Angeles, CA is $970,592, down 0.5% over the past year. Learn more about the Los Angeles housing market and real estate trends.

Zillow Home Value Index (ZHVI), built from the ground up by measuring monthly changes in property level Zestimates, captures both the level and home values across a wide variety of geographies and housing types.Learn more about the Zillow Home Value Index

Good news: The 2025 housing market is finally looking up after a rocky few years. Mortgage rates have eased from last year’s highs, and in many markets, buyers have more home choices. Housing prices are still high, but the breakneck rate of increases from years past has slowed.

The Federal Housing Finance Agency (FHFA) reported that annual home prices increased by 2.9% in the second quarter of 2025. Case-Shiller’s national housing price index was even softer, showing a 1.9% gain in June 2025.Rest assured, houses will still be there in the new year. ... It depends less on the calendar year and more on your personal finances. Rates have stayed under 7% for most of this year, inventory is improving, and price growth has cooled — all positives for buyers in 2025.But a “good” time to buy a house depends on whether you can comfortably afford the payment, have a stable income, and plan to stay put for a while. If you can check these boxes, 2025 offers opportunities that weren’t around a few years ago in the frenzied pandemic market. Nationally, a big price drop isn’t on the horizon.Data from FHFA and Case-Shiller show prices are still inching up, just at a slower pace than in past years. That said, some local markets are experiencing flat or slightly lower prices, particularly where inventory is building. If you’re house hunting, don’t count on a nationwide discount.

The average home value in Dallas, TX is $315,056, down 4.6% over the past year. Learn more about the Dallas housing market and real estate trends.

Zillow Home Value Index (ZHVI), built from the ground up by measuring monthly changes in property level Zestimates, captures both the level and home values across a wide variety of geographies and housing types.Learn more about the Zillow Home Value Index

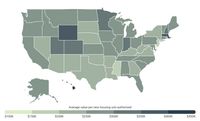

As home prices continue to climb across the United States, housing affordability remains a critical concern for both prospective buyers and policymakers.

As home prices continue to climb across the United States, housing affordability remains a critical concern for both prospective buyers and policymakers. A new study on behalf of construction industry research firm Construction Coverage has identified the U.S.These conditions highlight the ongoing pressure to expand the supply of affordable homes. This analysis draws on data from the U.S. Census Bureau and Zillow to examine national home price trends, builder activity, and the cities and states where new housing is being developed most affordably.With fewer homes being built—especially at lower price points—the slowdown threatens to worsen the already limited supply of affordable housing, leaving many buyers with even fewer options.cities and states where new housing is being developed most affordably. Over the past decade, persistent price growth—driven by limited supply, strong demand, and rising construction costs—has reshaped access to homeownership nationwide. Recent data from the National Association of Realtors (NAR) shows that while inventory has improved modestly, middle-income households still face significant gaps in affordability.

The leading real estate marketplace. Search millions of for-sale and rental listings, compare Zestimate® home values and connect with local professionals.

Houston real estate · Indianapolis real estate · Jacksonville real estate · Kansas City real estate · Las Vegas real estate · Long Beach real estate · Los Angeles real estate · Louisville real estate · Memphis real estate · Mesa real estate · Miami real estate ·Houston apartments for rent · Jersey City apartments for rent · Long Beach apartments for rent · Manhattan NYC apartments for rent · Miami apartments for rent · Minneapolis apartments for rent · New York City apartments for rent · Oakland apartments for rent ·

The average home value in Boston, MA is $779,777, up 0.9% over the past year. Learn more about the Boston housing market and real estate trends.

Zillow Home Value Index (ZHVI), built from the ground up by measuring monthly changes in property level Zestimates, captures both the level and home values across a wide variety of geographies and housing types.Learn more about the Zillow Home Value Index

MSN Money is your source for the latest stock market quotes, business, economic & financial news, as well as premium research tools to empower your investing journey

KING 5 News (NBC Seattle)Seattle Leading Local News: Weather, Traffic, Sports & MoreSee Seattle through new lens with our flagship YouTube series, Local Lens...

KING 5 News (NBC Seattle) Seattle Leading Local News: Weather, Traffic, Sports & More See Seattle through new lens with our flagship YouTube series, Local Lens Seattle! [KING 5 Media Group, a TEGNA company]

According to Redfin, housing costs could return to “normal” July 2018 levels by November 2030, provided mortgage rates fall to 5.5 percent, household income continues to rise at 3.9 percent annually and home prices keep climbing at their current 1.4 percent pace year-over-year.

San Francisco is the only major metro where housing costs have already returned to July 2018 levels. That’s mainly because its mortgage payment-to-income ratio is far above the national average — over 67 percent in July, down from 74 percent in 2018. The median home price in the California city was nearly $1.5 million in July, a return to normal, though far from what most would consider affordable.Other tech-driven metros, particularly those where wages are rising and home price growth has eased, like Austin, Texas, and Denver, may see housing costs hit 2018 affordability levels within the next year or so.If that happens, it could mark the end of the roller coaster ride the U.S. housing market has been on since the pandemic. That ride was fueled by rock-bottom mortgage rates that set off bidding wars, pushing up prices more than 40 percent in just a few years, while tight supply and investor demand added further pressure.Even if that happens, about half of the nation’s major metros — including New York, Chicago, Boston and Philadelphia — would not see housing costs return to normal within the next decade if home prices keep growing at their current pace.

UK house prices increased for the third straight month to hit the highest on record in August, data from the mortgage lender Halifax showed Friday. House prices grew 0.

British house prices rose 0.3% in August, a third consecutive monthly increase that leaves them 2.2% higher than a year earlier, figures published by mortgage lender Halifax showed on Friday.

LONDON, Sept 5 (Reuters) - British house prices rose 0.3% in August, a third consecutive monthly increase that leaves them 2.2% higher than a year earlier, figures published by mortgage lender Halifax showed on Friday.Economists polled by Reuters had forecast prices would rise 0.1% on the month and be 2% higher than the year before. Sign up here. British house prices have been rising more slowly than consumer price inflation in recent months, after a surge in the first quarter of this year when buyers sought to take advantage of the final months of a tax break on property purchases.August data from rival mortgage lender Nationwide on Monday showed that prices unexpectedly dropped 0.1%, causing annual house price inflation to slow to 2.1% from 2.4%.“While the wider economic picture remains uncertain, the housing market has shown over recent years that it can take these challenges in its stride," said Amanda Bryden, Head of Mortgages at Halifax. "Supported by improving affordability and resilient demand, we expect to see a slow but steady climb in property prices through the rest of this year."

Mark Fleming’s analysis is based on First American’s Real House Price Index, which, unlike other home-price indexes, accounts for inflation.

High mortgage rates and home prices sidelined homebuyers for years. ... Housing affordability in the U.S.Meanwhile, home price growth is mostly flat or slightly declining because of decreasing demand and increasing supply, according to the National Association of Home Builders. “For prospective buyers who have been waiting on the sidelines, the housing market is finally starting to listen,” wrote chief economist Mark Fleming in an Aug.While a glance at most other home-price indexes would show a stark increase in home prices, First American’s actually shows national housing affordability rose 3.1% year over year in June, marking the fifth consecutive month with an annual gain.However, if one were to look at something like the Case-Shiller Home Price Index, it would show home prices are nearly 50% higher than they were five years ago. The RHPI also differs from other pricing indexes because it measures consumer buying power over time (taking into account the impact of income and interest rate changes), while other indexes like Case-Shiller track home value changes over time. There are some promising signs housing affordability is improving: Mortgage rates are slightly declining, home-price growth is slowing, and household incomes are somewhat increasing, according to First American.